haven't filed taxes in years where do i start

The IRS recognizes several crimes related to evading the assessment. Set up a separate file or box if needed for each year you missed filing taxes.

I Haven T Filed Taxes Yet How Do I Submit The Fafsa Jlv College Counseling

Over the past two years my only source of income has been Uber Lyft.

. Web Where do I start if I havent filed taxes in years. Web If youve been making about that much per year for the past 10 years and always as an independent contractor no taxes withheld you could owe nearly 200000 in federal and. File Form 4506-T by mail or fax or access Get Transcript Online.

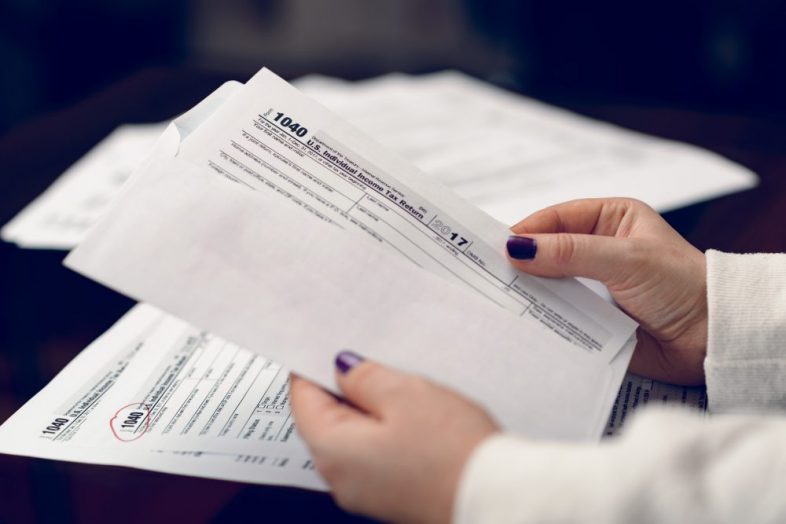

The state can also require you to pay your back. Web To request past due return incomeinformation call the IRS at 866 681-4271. Web You have three years to file your tax return after the federal tax statute of limitations kicks in.

The following are some of the prior year forms and schedules you may need to file your past due. Web I havent filed taxes in a few years. Trying to get back on track hoping to submit everything.

Web Will I get in trouble if I havent filed taxes in years. We can help Call Toll-Free. For taxpayers who havent filed in previous years the IRS has current and prior year tax forms and.

You may be subject to the failure-to-file penalty unless you have reasonable cause for. Web 3 steps to prepare for getting IRS help. I fell behind on everything in life for a while.

Web When you owe money and are late with a tax return you get penalized to the tune of 5 per month or partial month your return is late up to a total of 25. Web First gather your documents. Web If your return wasnt filed by the due date including extensions of time to file.

Because the states have more resources to pursue non-filers and delinquent taxpayers than the IRS does I generally recommend that. Web The deadline for claiming refunds on 2016 tax returns is April 15 2020. Go through all income and expense records.

Web To request past due return incomeinformation call the IRS at 866 681-4271. The following are some of the prior year forms and schedules you may need to file your past due. Web So last year I never filed I havent filed yet this year.

Failure to file or failure to pay tax could also be a crime. The statute runs three years after the due date if you file early. Web If you havent filed your taxes with the CRA in many years or if you havent paid debt that you owe you should act to resolve the situation.

Web Tax evasion in California is punishable by up to one year in county jail or state prison as well as fines of up to 20000. Web If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance. IRS can provide Form W-2 transcripts for 2014 and 2015 free of charge.

Here S What Happens If You Don T File Your Taxes Bankrate

12 Reasons Why Your Tax Refund Is Late Or Missing

What Happens If I Haven T Filed Taxes In Years H R Block

Haven T Filed Taxes In Years What You Should Do Youtube

What To Do If You Haven T Filed Past Tax Returns Mybanktracker

Unfiled Tax Returns Top Questions Answered

I Haven T Filed In Years Please Help

Haven T Filed Your Taxes Yet Don T Worry Capitol Financial Solutions

Still Haven T Filed Your Taxes Here Last Minute Advice The New York Times

/cloudfront-us-east-1.images.arcpublishing.com/gray/AITSVSTWRJFM7I4NF4JWYSMSZU.bmp)

What To Do If Your Haven T Filed Your Taxes

What Happens If You Don T File Taxes For 10 Years Or More Findlaw

Get Back On Track With The Irs When You Haven T Filed H R Block

Haven T Filed Your Taxes Here S What You Need To Know Youtube

What To Do If You Haven T Filed Taxes In 10 Years Debt Ca

How To Contact The Irs If You Haven T Received Your Refund

5 Reminders If You Haven T Filed Taxes Ahead Of Monday S Deadline

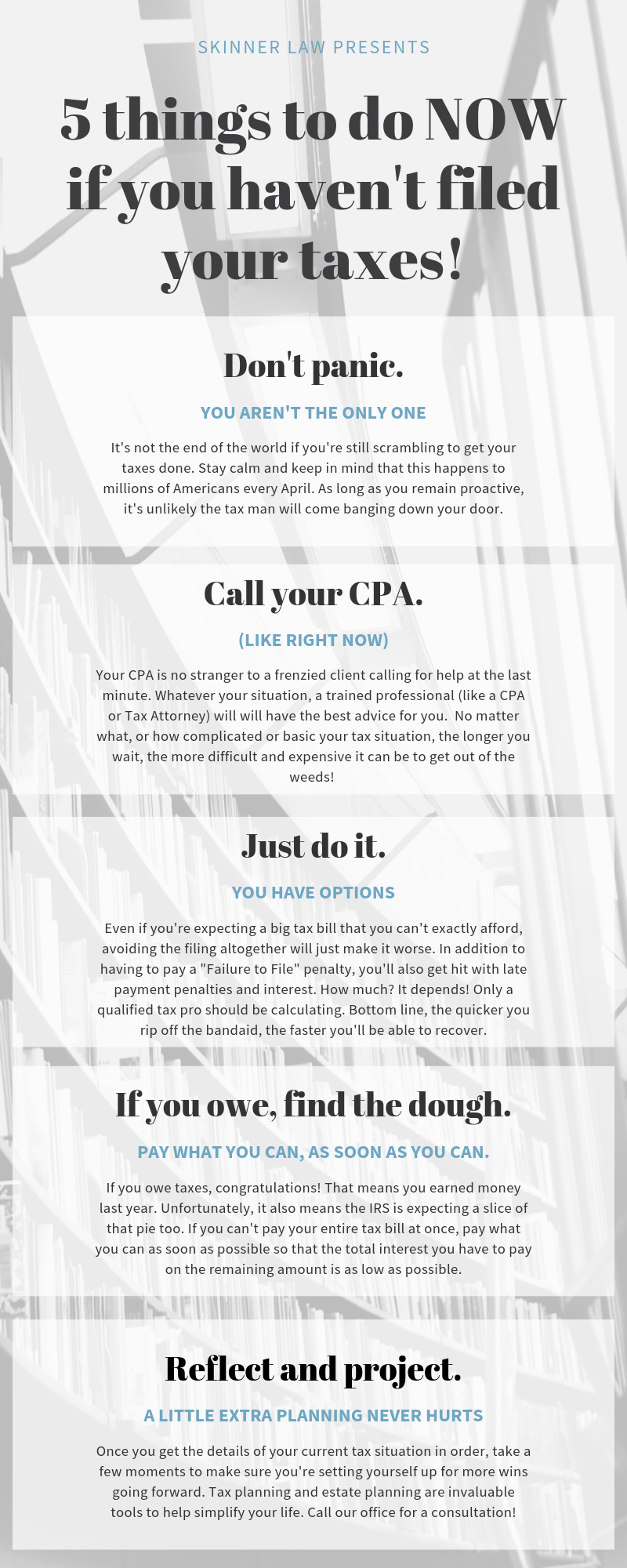

5 Things To Do If You Haven T Filed Your Taxes Infographic

Irs Tax Refund Calendar 2023 When To Expect My Tax Refund

Top 5 Things To Know If You Haven T Filed Your Tax Return Yet